does fla have an estate tax

There are no inheritance taxes or estate taxes under Florida law. This applies to the estates of any decedents who have.

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes.

. Florida residents do pay a property tax. Federal estate taxes are. Florida Property Tax.

The average property tax rate in Florida is 083. The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. Property taxes apply to both homes and businesses.

Any income the assets generate become part of the estate and may require you to file an estate income tax. Florida doesnt have a personal income tax nor does it have an estate tax or an inheritance tax. Florida does not collect an estate tax.

The majority of US. States Florida included do not levy a tax on estates though the federal government does if the estate is large enough. However the federal government imposes estate taxes that apply to all residents.

Does Florida Have an Inheritance Tax or Estate Tax. It does however impose a variety of sales and property taxes and some are. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

Trusts and estates will not be permitted to deduct investment fees and expenses and reimbursed business expenses among others Look for more information on changes to income tax laws. Federal Estate Tax. Federal Estate Taxes.

In 2022 the estate tax threshold for federal estate tax. That amount increases to 1206 million for the 2022 tax. You can learn more about Florida.

There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. When someone dies their assets become property of their estate. Florida does have a property tax on all properties you own and if you are renting or selling that property you may be required to pay federal taxes on any profit made.

Its actually below the national average despite the state having no income tax. The state of Florida doesnt have an estate tax but that doesnt make you exempt from the Internal Revenue Services federal estate tax. There are also special tax districts such as.

The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US. However federal IRS laws. Florida Does Not Have an Estate Tax But The Federal Government Does Fifteen states levy an estate tax.

All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes. Each county sets its own tax rate. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance.

The state constitution prohibits such a tax though Floridians. Florida doesnt have an inheritance or death tax. The good news is Florida does not have a separate.

The federal estate tax. Florida also does not collect an. The estate tax exemption was then increased in 200000.

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Inheritance And Estate Taxes In Florida Specific Strategies Individ

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

Do I Have To Pay Federal Estate Tax From My Inheritence

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Estate Tax Rules On Estate Inheritance Taxes

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

![]()

Does Florida Have An Inheritance Tax Alper Law

![]()

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Smoothly Transferring Estate Assets In Florida Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Probate Tax Stuart Probate Lawyer John Mangan Can Help

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

The Complete Guide To Planning Your Estate In Florida A Step By Step Plan To Protect Your Assets Limit Your Taxes And Ensure Your Wishes Are Fulfilled For Florida Residents Ashar Linda C 9781601384287

In Florida Homeowners Come For The Weather And Stay For The Tax Relief Mansion Global

9 States With No Income Tax Bankrate

What You Need To Know About Estate Tax In Fl

Dr 312 2002 Form Fill Out Sign Online Dochub

Florida Estate Tax Everything You Need To Know Smartasset

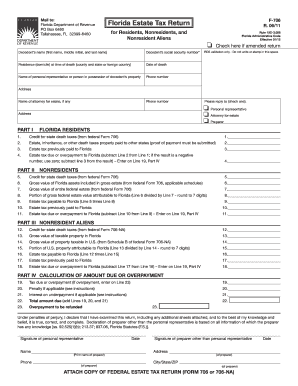

Florida Estate Tax Return F 706 Fillable Online Form Fill Out And Sign Printable Pdf Template Signnow