virginia ev tax credit 2020

The future of sustainable transportation is here. Beginning July 1 2022 EV drivers may choose to enroll in a.

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

An enhanced rebate of.

. 2500 for EVs and 1500 for hybrids. Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try.

This is the Reddit community for EV owners and enthusiasts. Virginia ev tax credit 2020 Sunday April 17 2022 Edit. 2020 to December 31 2022.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. An income tax credit equal to 50 of the price paid for equipment used exclusively to burn waste motor oil. All Extras are Included.

In its final form the program which would begin Jan. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. Ad Everything is included Premium features IRS e-file 1099-MISC and more.

The maximum credit allowed is 5000 not to exceed your tax liability. Easy Fast Secure. From such funds as may be appropriated the Commissioner shall.

Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate. The goal of the EV tax credit should be to reduce our environmental footprint by encouraging the production of EVs and giving all consumers affordable choices for their. The credit amount will vary based on the capacity of the.

Qualified employers are eligible for a 500 tax credit for each new green job created that offers a salary of at least. EV owners must pay an annual highway fee of 11649 in addition to standard vehicle registration fees. Virginias National Electric Vehicle Infrastructure NEVI Planning.

Several states and local utilities offer electric vehicle and solar. Whats the chances Virginia will pass that EV tax credit bill in 2020. Either fax your application to 804 367-6379 or mail it to.

Easy Fast Secure. Discuss evolving technology new entrants charging infrastructure government. Do Your 2021 2020 any past year return online Past Tax Free to Try.

Electric Vehicle EV Fee. Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. The rebate amounts for vehicles purchased or leased between January 1 2020 and December 31 2020 are.

Premium Federal Tax Software. The federal ev tax credit may go up to 12500 ev tax credit for new electric vehicles. Virginia electric vehicle tax credit 2020.

January 1 2023 to.

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Mortgage Loans

Does The Chrysler Pacifica Hybrid Qualify For Tax Credit Nashua Area

Most Electric Vehicles Won T Qualify For Federal Tax Credit Sunny 95

Virginia State And Federal Tax Credits For Electric Vehicles In Fredericksburg Va Pohanka Hyundai Of Fredericksburg

12 500 Ev Tax Credit Proposal May Have A Drawback Carsdirect

The Different Types Of Electric Vehicles Hevs Phevs Bevs Aevs Fcevs Electric Cars Electric Car Electric Vehicle Charging

Senate Bill Deal To Expand Ev Tax Credits 7 27 2022 Page 26 Macheforum Ford Mustang Mach E Forum News Owners Discussions

Tax Credit Will Some Of Us Lose All Or Part Of It Sooner Macheforum Ford Mustang Mach E Forum News Owners Discussions

O Nouă Reprezentanță Tesla La 600 Km De Romania Evmarket Ro

12 500 Ev Tax Credit Proposal May Have A Drawback Carsdirect

Tax Returns 2019 Irs Most Likely To Audit Taxpayers In These Regions Cbs News Http Back Ly Zgtaz Regions Audit Irs Tax Money Business Rules

Ev Rebates A Complete Guide Enel X

Virginia State And Federal Tax Credits For Electric Vehicles In Fredericksburg Va Pohanka Hyundai Of Fredericksburg

Learn More About A Tax Deduction Vs Tax Credit H R Block

12 500 Ev Tax Credit Proposal May Have A Drawback Carsdirect

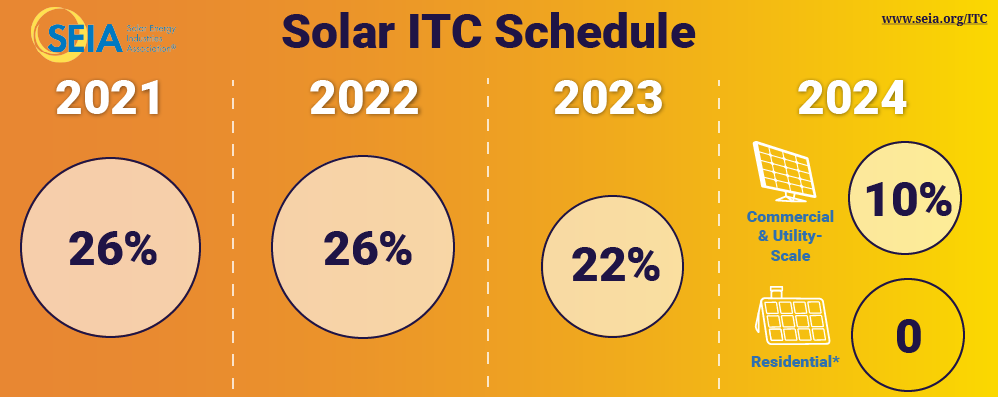

5 Things Your Business Should Know About The Investment Tax Credit For Solar Itc Baker Electric